Our Strategy

The problem with most advisors is that they tell you when to get into investments, but they never tell you the most important part of asset management... when to sell.

We utilize a two-pronged approach to constructing and managing our portfolios. Fundamental research tells us where we are in the economic cycle. This determines what we should own and why. The second-factor signals when we should buy/sell those positions, we call it Alpha Strategy.

Alpha Strategy

Avoiding major drawdowns in the market is the key to long-term investment success. If you are not spending the bulk of your time making up previous losses in your portfolio, you spend more time compounding your invested dollars towards your long term goals.

We have spent the last several years developing and refining a data-driven, mathematically based strategy to execute this mantra. Enter Alpha Strategy.

We utilize dual factors, Price and Volatility data, run it through a calculation to help us determine how much risk is in the market every day. We can then conclude, due to historical data, what the probable direction will be for the market going forward. Our proprietary market signal takes the emotion out of the execution and management of our clients’ portfolios. We don’t make decisions based on what we feel or what headlines are on CNBC. It’s math. It’s data. This is critical to the success of our strategy and, most importantly, makes this a systematic and repeatable process.

For results from our Alpha Strategy signal, please contact us.

Below are examples of Alpha Strategy exiting before the decline in the stock market in 2008, and most recently, 2018.

***Alpha Strategy is not an investment product. It is solely a market signal to help us determine when to add or remove risk from our clients' portfolios

Macro Research

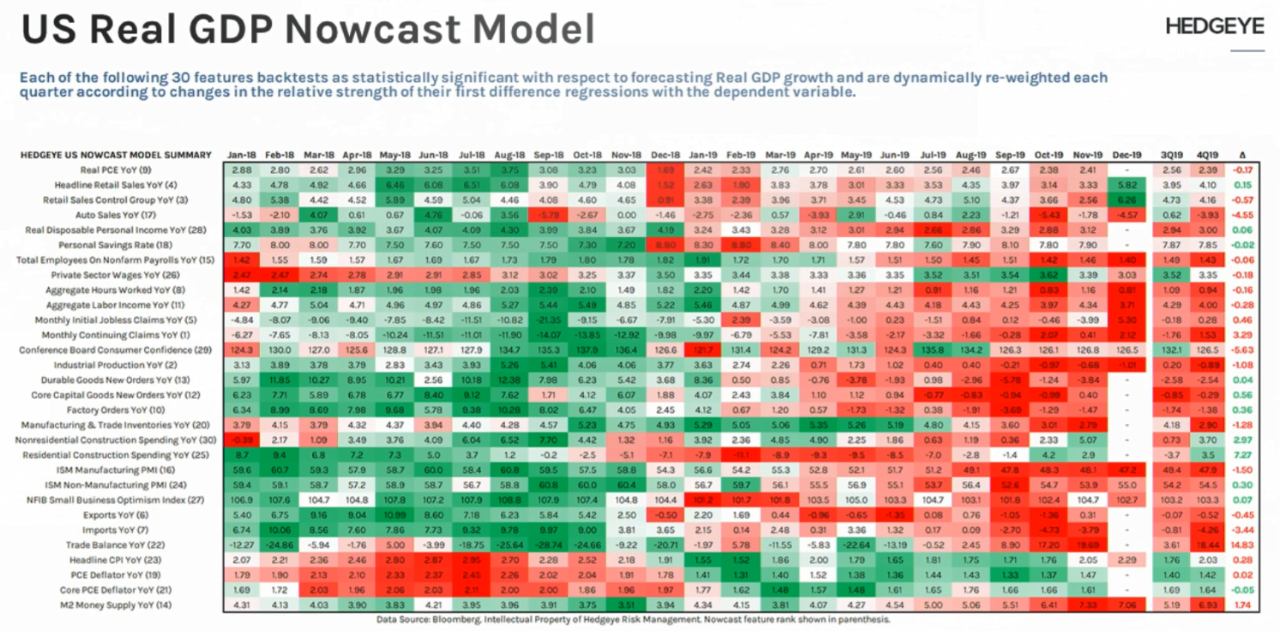

Our fundamental analysis is driven by Hedgeye Macro Research. Hedgeye is an independent research firm that has a team of more than 40 macro and fundamental analysts that measure and map economic data daily. Their unique process and non-consensus approach give us the edge over Wall Street firms.

We utilize their research to help us determine where we are in the economic cycle.

The two factors that drive the direction of the stock market and interest rates are Growth and Inflation. By measuring and mapping the data daily, we can determine whether Growth and Inflation are accelerating or decelerating. We then have a playbook based upon historical backtests, which tells us the best sectors to own. Next, we use our market signal, Alpha Strategy, to determine when to buy or sell those sectors.

Measuring and Mapping 30 data points every month to help us determine where we are in the economic cycle with respect to growth and inflation.